Being a “homemaker” or stay-at-home mom has been a hot topic in the news recently. This topic has certainly proven to be a bit of a lightning rod, and there is no one-size-fits-all for families. I simply want to provide a framework for families to consider the possibility of a stay-at-home mom. Not that long ago, my own family was considering this same decision, and it took laying it out in black and white for us to cut through societal pressure and expectations and make the best decision for our family.

While there is certainly no way to divorce the question of a stay-at-home mom from finances, at its core, I truly don’t believe that this is a financial decision. Ultimately, this decision will reflect the goals, dreams, and desires of the couple making this choice. We have been fortunate to experience my wife both as a working mom and as a stay-at-home mom. While this is in no way meant to be critical of anyone’s choices, we began to experience much greater satisfaction in our family life when she started staying at home and regret not making that decision sooner. My goal for this piece is to make a practical use case to a younger version of myself that would convince us to pull the trigger even sooner and experience the joy that we have received from this decision for an even longer period of time.

Financial Decision vs. Family Decision

The decision to have a parent stay at home full-time reflects the goals, dreams, and desires of the couple. My family, at different times, has experienced my wife working full-time, part-time, and staying at home full-time. There are pros and cons to all ways, but the peace we have found in having her be the full-time caregiver for our children has been incredible, especially during our busy seasons as a family. If you are a family who would like to have a parent stay at home, I’d like to lay out the financials to help make your decision a little clearer.

Financial Realities and Cultural Roadblocks

While I believe this is fundamentally a lifestyle choice, it would be silly to act as if there aren’t significant financial repercussions to this decision. There are significant roadblocks from both cultural and governmental standpoints that act as deterrents for young families who desire to make this decision. However, financially, the choice to have a parent stay at home is really no different from any other large financial decision, such as buying a home, starting a family, or taking an early retirement. Having worked with many families contemplating these choices, I can honestly say it never is going to feel like the right time. As humans, we are hardwired to snuff out fear around every corner.

What if we run out of money? What if we have major medical expenses? What if a tiger escapes from the zoo and eats my husband for dinner? While these are very real concerns (okay, maybe not the tiger, but concern for a premature death is very real), it is critical to plan based on what is most likely and create contingency plans for the worst-case scenarios. I often tease my wife that her superpower is jumping to the worst-case scenario in a single bound. As I said above, plan for the most likely and create contingencies (often with insurance and an emergency fund) for when things don’t go according to plan.

Note: Don’t worry, I’m not actually making fun of my wife or being inconsiderate. She makes all my graphics, so she designed this image of her own accord.

Steps to Making the Decision

I will break down each step in detail below, but here are the seven steps to giving you the confidence to make the decision to stay at home. Hint: This same process can also be applied to any large financial decision.

- Track Expenses

- Detail Income and the Impact of Pending Changes

- Determine What Will Change and What Can Be Possible

- Build Up Your Emergency Fund to 6 Months of Expenses

- Consider Proper Insurances: Health, Life, Disability, etc.

- Discuss Changes with Your Employer

- Give It a Test Drive

1. Track Expenses

The first step in preparing for a stay-at-home lifestyle is to get a clear understanding of your current financial situation. Begin by tracking all your expenses for at least three months. This includes everything from major bills like rent or mortgage, utilities, and groceries to smaller purchases like coffee and streaming subscriptions. Use a budgeting app or a simple spreadsheet to categorize these expenses. The goal is to see where your money is going and to identify areas where you might be able to cut back. Understanding your spending habits is crucial to making informed decisions about how much income you truly need to maintain your desired lifestyle.

2. Detail Income and the Impact of Pending Changes

Next, take a close look at your household income. This includes salaries, bonuses, freelance work, and any other sources of income. Consider how these will be impacted if one partner decides to stay home. For instance, if your spouse is currently working, how will your family’s financial picture change without their salary? Don’t forget to account for potential changes in taxes, retirement contributions, and benefits. It’s also important to explore potential side incomes or part-time opportunities that could supplement your primary income, helping to ease the transition.

3. Determine What Will Change and What Can Be Possible

After tracking your expenses and detailing your income, it’s important to evaluate how your financial landscape will shift and what new opportunities might arise. This involves understanding the changes in your budget and recognizing the possibilities that come with having a parent at home.

- Budget Adjustments:

- Reduced Expenses: It is critical to consider all the budget savings that exist when going to a single income household. While some savings like daycare may be obvious, there can be other substantial savings such as taxes that will have a dramatic impact on the amount of money that you take home. Be sure to read this blog all the way to the end to see a sample budget when going down to a single income.

- New Expenses: Conversely, you might incur new costs such as higher utility bills due to more time spent at home or additional expenses for home activities and supplies.

- Flexible Spending: Examine discretionary spending—like entertainment, subscriptions, and personal hobbies. Identify areas where you can cut back or find more affordable alternatives. This doesn’t mean sacrificing your quality of life but rather prioritizing your spending in ways that align with your new lifestyle.

- New Opportunities:

- Homemade Savings: Having a parent at home can open up opportunities for savings in areas such as cooking meals from scratch, DIY home projects, and more hands-on parenting, which can reduce the need for paid activities or services. A big and obvious one here would be reducing the amount budgeted for restaurants due to increased availability to make food at home.

- Side Income Potential: Explore possibilities for generating additional income. This could be through freelancing, part-time work, or turning a hobby into a small business. These ventures can provide financial support without demanding full-time commitment.

By carefully considering what will change and what will be possible, you can make informed decisions that support a smooth transition to a stay-at-home lifestyle. Recognizing both the adjustments and the opportunities will help you create a realistic and sustainable plan for your family’s future.

4. Build Up Your Emergency Fund to 6 Months of Expenses

Having a robust emergency fund is crucial, especially when transitioning to a single income. Aim to save at least six months’ worth of your newly projected expenses. This fund acts as a financial safety net, providing peace of mind and security in case of unexpected events like medical emergencies, car repairs, or job loss. Building this fund might require tightening your budget temporarily or finding ways to increase your income until you reach your savings goal. While a good chunk of this should be readily available in a savings account, consider other places where you may have access to cash if it is necessary, such as life insurance cash values or non-qualified investment accounts. While getting overly hung up on a specific number can detract from your overall goal, having a relatively robust emergency fund is critical to giving you the confidence to make this a reality…remember, don’t leap to the worst-case scenario in a single bound, but instead plan for the most likely scenario and have contingencies in place.

5. Consider Proper Insurances: Health, Life, Disability, etc.

Having proper insurance coverage in place is another big piece in giving you the confidence to move forward. Due to your pending change in employment, you may need to change health insurance coverage. While going onto your spouse’s insurance coverage may be the most obvious, there is a very real chance that utilizing the healthcare marketplace will become an attractive option as your lower income may qualify you for a subsidy. The key is to evaluate all possible options and choose what fits your family the best.

In addition to health insurance, consider life and disability insurance. While an early death or disability aren’t the most likely of outcomes, the consequences are disastrous. While this is certainly not a one-size-fits-all solution, I recommend having a minimum of 10x the salary for the primary earner and 50% of that amount for the stay-at-home parent. For disability insurance, I recommend coverage for 60% of your current income. Often, there can be affordable options through your employer, but if not, you can obtain disability insurance through an independent insurance broker or financial advisor.

6. Discuss Changes with Your Employer

While everything before this is simply setting the table, this is where the rubber meets the road. I certainly encourage you to have open and honest communication with your employer, however having this discussion may have an impact on future opportunities within your current job. With that being said, many employers will be happy to work with you on the possibility of a more part-time and flexible role. This may be the key to helping bridge the gap as your spouse continues to advance their career, giving you the increased income to fully stay at home if that is your desire. This conversation can help you explore ways to stay connected to your career while accommodating your family’s needs. Working in a part-time capacity can be a wonderfully beneficial way to supplement your family’s income, stay connected to your field (particularly if you have a desire to re-enter the workforce at a later time), and give you a much-needed break from the kiddos on occasion.

7. Give It a Test Drive

Before making a permanent decision, consider giving the stay-at-home lifestyle a test run. Try living on a single income for a few months while the other partner’s income goes directly into savings. This trial period will help you identify any unforeseen challenges and adjust your budget accordingly. It also provides a practical glimpse into how your day-to-day life might change and whether the financial adjustments you’ve made are sustainable in the long run. Use this period to fine-tune your plans and ensure you’re both comfortable and confident in your decision.

By following these seven steps, you can create a solid foundation for transitioning to a stay-at-home lifestyle. Each step is designed to help you understand your financial situation better, make necessary adjustments, and prepare for potential challenges.

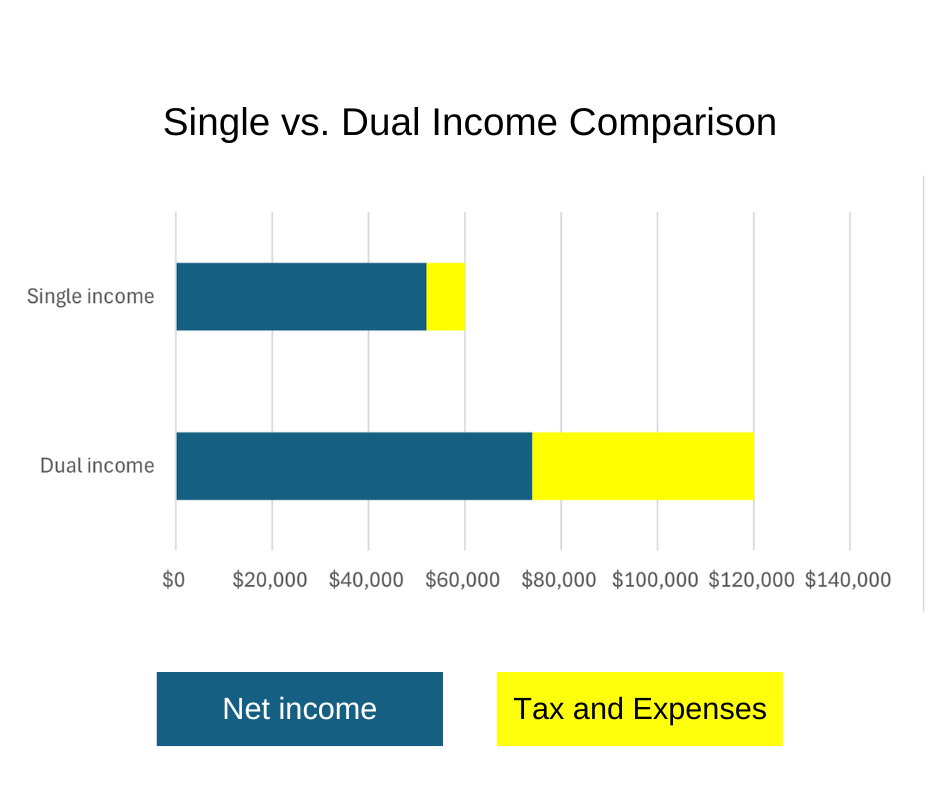

Practical Example: Single Income vs. Dual Income

When considering staying at home, couples often overestimate how much net income that they will be losing. This is because taxes, childcare, and other work related expenses act as a silent thief to their total take home pay. Often reducing to a single income can eliminate (in the case of daycare) or greatly reduce (in the case of taxes) these expenses. Additionally, we have left off state taxes in this example as they can vary significantly from state to state. However, in my home state of Kansas, taxes would reduce from $5,213 for a dual income family to $1,849 for a single income family for a total reduction of $3,364 in state income taxes

While no two situations will look the same, it can be impactful to look at the practical example of Mickey and Minnie Mouse. Mickey and Minnie have two young children and are both employed, each making $60,000 per year.

Dual-Income Household:

- Total Income: $120,000

- Employment Taxes: $9,180

- Federal Income Taxes: $10,921

- Total Taxes: $20,101 (17% of income)

- After-tax Income: $99,899

- Daycare: $20,000

- Commute, Wardrobe, and Other Work-Related Expenses: $6,000

- Net Income: $73,899

Single-Income Household:

- Total Income: $60,000

- Employment Taxes: $4,590

- Federal Income Taxes: $3,436

- Total Taxes: $8,026 (13% of income)

- Net Income: $51,974

When Mickey and Minnie were contemplating Minnie staying at home, they couldn’t get past the idea of giving up $60,000 each year. However, after their analysis, they realized they were not giving up $60,000 but instead just over $20,000 each year, or slightly above $1,800 each month.

This situation was very similar to ours when my wife began to stay at home. We had a few more kids, and thus higher daycare expenditure. Once we did this same analysis, we realized my wife was working for $17,000 per year. Choosing to have her stay at home became a much easier decision after this realization.

While I still firmly believe that staying at home is not at its core a financial decision, I do believe that the sheer economics of it are what hold many back from making this decision. It is my sincere hope that this blog can help bridge the gap from something that may seem impossible to something that is feasible for your family. We feel incredibly blessed that my wife has been able to stay home with our children for the past six years. If you have the opportunity to hold that ever-important title of stay-at-home mom, go for it. It is so worth it! Our only regret is that we did not do it sooner.

This post is for education and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.