Every election year, there’s a familiar sense of heightened attention, fueled by political drama, media overload, and global uncertainty. It’s easy to think that these times call for drastic measures—especially when it comes to your investments. But here’s the thing: trying to predict how the stock market will respond to election outcomes is a losing game. History is full of surprises, and making investment decisions based on political predictions can be risky. Let’s take a look at what history tells us about market performance before, during, and after elections, and how you can avoid costly mistakes.

Expect Volatility, But Don’t Fear It

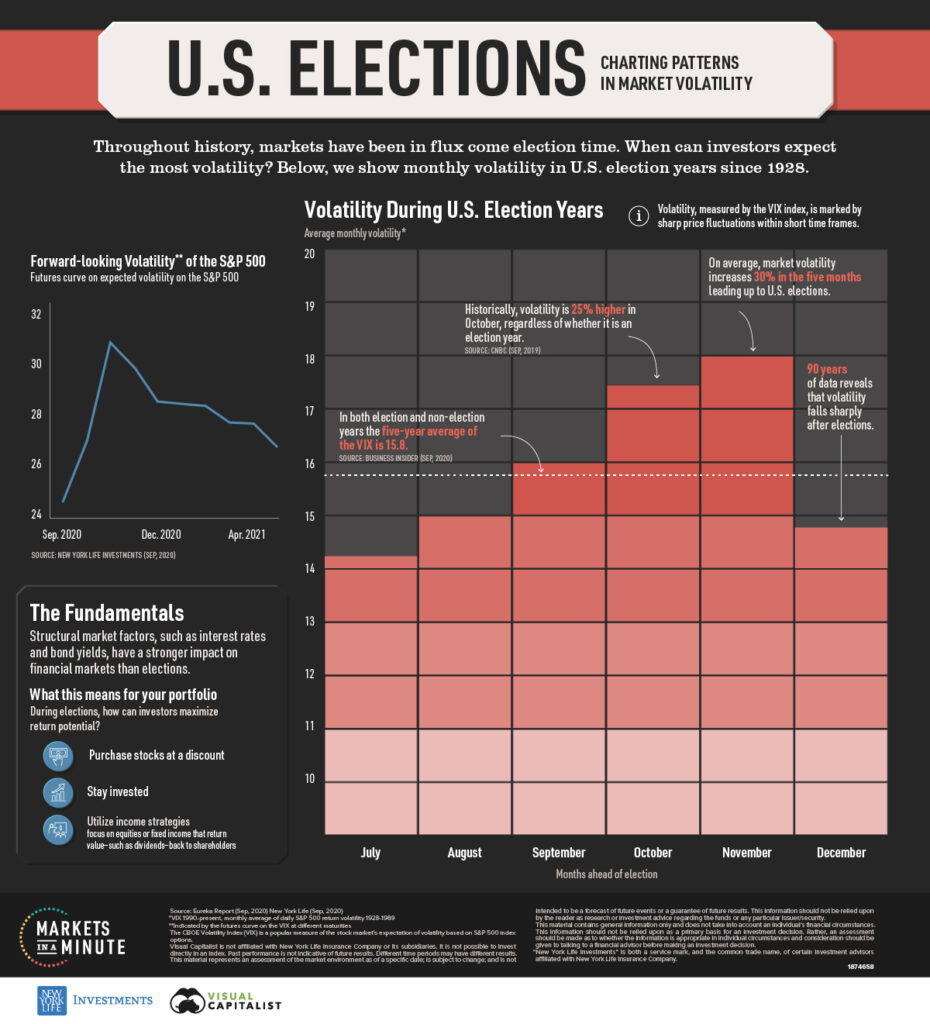

If there’s one thing you can count on during election season, it’s market volatility. Whether it’s the presidential debates or new polling data, the stock market doesn’t love uncertainty, and elections serve up uncertainty on a silver platter. But here’s the thing—volatility, though stressful, is not inherently bad. It’s a normal part of the market’s behavior and not something that should send you scrambling to make changes.

Many people panic when they see their portfolio’s value swing wildly, but remember: this is usually short-term noise. At my firm, I am always reminding clients that long-term investing requires tuning out the distractions. This means no sudden changes because of the latest election news—no matter how big it seems at the moment.

Source: U.S. Elections: Charting Patterns in Market Volatility – Advisor Channel (visualcapitalist.com)

Behavioral Finance: Why We’re Hardwired to Worry

One of the biggest issues during election season is what behavioral finance calls “loss aversion.” Basically, humans tend to feel the pain of losses more acutely than the pleasure of gains. So, if the markets take a hit in the run-up to an election, our instinct is to pull out our investments, hoping to dodge the drop. The problem is, when we act on these impulses, we lock in losses and often miss out on the market’s recovery.

This emotional reaction is one of the reasons why investing based on political events is so dangerous. The market’s ups and downs have a way of triggering our worst instincts. Your portfolio doesn’t care about your politics—it cares about fundamentals, discipline, and time in the market.

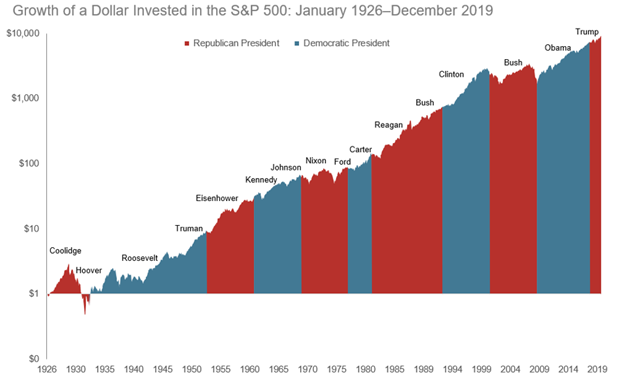

Predictions Are (Almost) Always Wrong

If you still feel compelled to make a move based on what you think might happen post-election, let’s take a little trip back to 2016. Most “experts” were predicting that a Trump victory would send the market into free fall. And in the hours after his victory, stock futures did plummet. But what happened next? The market rebounded, and by the end of the day, the S&P 500 was up over 1%. The following years? An average return of over 14% annually.

The lesson here is clear: No one, not even the brightest financial minds, can predict how the market will react to political events. Trying to time the market based on election results is like trying to catch a falling knife—you’re more likely to get hurt than come out ahead.

The Stock Market Isn’t the Economy

One common misconception is that the stock market is a perfect reflection of the economy, especially during election years. But the truth is, the stock market is driven by a variety of factors beyond just the current political situation. While they are each impacted by a confluence of factors, the stock market is often more forward-looking and can be impacted by other variables, such as corporate earnings, interest rates, and global events.

In fact, history shows that the performance of the stock market leading up to an election has actually been a better predictor of who wins than the state of the economy. When the market is doing well in the months leading up to the election, the incumbent party tends to win. When the market is down, the incumbent party typically loses. This statistic can be fun to note but doesn’t tell you how to manage your portfolio, or who will necessarily win this election.

Say it With Me: Stay Calm!

Many of the wealthiest people I work with are often the least concerned about election-year volatility. Why? Because they understand that wealth-building is a long game. They’ve spent years, if not decades, making disciplined, sound financial decisions. They know that trying to time the market during election season is a losing strategy and that sticking to a well-thought-out plan yields better results over the long term. This long-term thinking is exactly what helps them keep their cool when markets get bumpy.

After the Election: The Market Settles

One of the most comforting things to remember is that the markets tend to calm down after elections. There’s always a flurry of activity in the lead-up to Election Day, but once the votes are counted, the markets begin to adjust to the new reality, regardless of which party is in power.

Historically, markets tend to perform better during election years than the year immediately following. This is largely due to the uncertainty that surrounds the new administration’s policies. Once those policies begin to take shape, the markets can recalibrate and move forward.

Another interesting tidbit? International markets often perform better the year after a U.S. presidential election. While the U.S. elections are important, global markets don’t hang on our every move. There are plenty of other factors, like trade policies, geopolitical issues, and global economic growth, that influence international performance.

What Should You Do?

So, with all of this in mind, what should you actually do with your investments as we head into 2024’s election season?

- Stick to the Plan – Your financial goals haven’t changed just because there’s an election. Whether you’re saving for retirement or another goal, your plan was built with the long-term in mind. Stay the course.

- Resist the Urge to Time the Market – Even if you think you have a good sense of what might happen, remember 2016. The market is unpredictable, and trying to outsmart it usually results in lost opportunities for growth.

- Diversify – If you’re properly diversified, you’ve already spread your risk across different asset classes and geographies. This means you’re better positioned to weather any short-term volatility that comes from election results.

- Turn Off the Noise – Media outlets thrive on sensationalism, especially during elections. Try to avoid getting sucked into the daily barrage of predictions and political spin. Your portfolio doesn’t need to react to every news story.

- Focus on What You Can Control – You can’t control the election, but you can control how much you’re saving, how diversified your portfolio is, and whether you stick to your financial plan.

The Bottom Line: Don’t Let Politics Derail Your Plan

At the end of the day, elections are important, but they’re just one of many factors that can influence the market. The key takeaway is this: don’t let the political noise push you into making emotional decisions with your investments.

History shows that markets have survived and even thrived through countless elections. The most important thing you can do is stick to your plan, avoid knee-jerk reactions, and focus on the long-term.

Keep calm, stay disciplined, and trust the process.

This post is for education and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.