What do fortune cookies, carnival weight guessers, and risk tolerance questionnaires have in common?

They all provide you with an answer—sometimes even a reasonably close one—but none are built on the rigorous foundation that your life’s savings demands. Just like trusting a fortune cookie to predict your future, relying on a risk tolerance questionnaire to define your investment strategy is…well, a bad idea.

Risk tolerance questionnaires are supposed to help financial professionals understand how much risk you’re comfortable with. They ask questions about how you’d feel if your portfolio dropped 10%, or 20%, or if the market took a nosedive. At the end of the day, they’re trying to gauge your “risk tolerance.” But here’s the catch—these questionnaires aren’t rooted in research, and they don’t really help you make sound financial decisions.

Risk Tolerance: Facts > Fear

To borrow a phrase from Ben Shapiro, “Facts don’t care about your feelings,” and, I would add, neither does your portfolio. If you’re trying to make a long-term investment strategy based on how you feel when the market is at an all-time high or plunging into a downturn (or really anywhere in between), you’re doing it wrong.

This isn’t just theory. Over the years, I’ve worked with clients who have come in with portfolios that have been adjusted based on fear rather than research. Many have been overly conservative, others overly aggressive, but in every case, the driving factor behind these decisions was emotion—not an informed, research-driven strategy.

In my office, I don’t rely on these questionnaires. Instead, I use a strategy called the bucket strategy, which has a research-backed, time-tested foundation that helps you invest in a way that makes sense for your specific financial needs.

What the bucket strategy does not have anything to do with….your feelings.

Why Your Risk Tolerance Shouldn’t Define Your Strategy

Risk tolerance—what you’re comfortable with emotionally—isn’t the best gauge for how your funds should be invested. Here’s the truth: just because you say you’re risk-averse doesn’t mean you should avoid aggressive investments altogether.

The key isn’t to build a portfolio based on how you feel but based on your specific financial goals and time horizons.

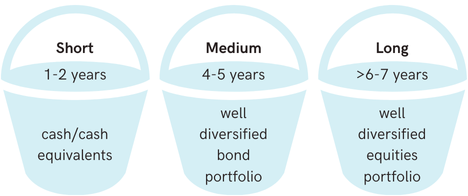

Consider this: your portfolio needs to reflect when you need the money, not just how much you’re willing to lose in a downturn. Money needed in the next year? That should be in cash for stability and liquidity. Money you need in the next 5 years? Put that in bonds. Money you don’t need for 5 years or more? Invest it in equities to maximize growth potential. While there is a bit more nuance to this when it comes to diversifying within asset classes, the overarching principles hold true.

The Bucket Strategy—A Better Way to Invest

I’ve seen first-hand the transformation this approach can bring. Clients who were previously in overly conservative allocations, thinking they should avoid risk entirely in retirement, have made the switch to a much more aggressive strategy once they understood the bucket system.

Here’s how it works:

- Short-Term Bucket: Money needed in the next year is kept in cash.

- Medium-Term Bucket: Money needed in the next 4-5 years is invested in a diversified bond portfolio.

- Long-Term Bucket: Anything not needed for 5+ years goes into equities for growth.

With the bucket strategy, you have emergency funds in place to handle volatility. When markets are up, you can replenish your cash bucket from equities. When markets are down, you can pull from bonds instead. The beauty of this strategy is that it allows you to stay invested in equities—the asset class with the highest expected return—without the need to panic when the market experiences short-term downturns. Your money is working for you, but it’s strategically organized to manage any market turbulence.

Common Misunderstandings About Market Volatility

One of the most common misconceptions that clients have is thinking that volatility is inherently dangerous. People hear “volatility” and immediately think “loss,” but the reality is that market volatility isn’t the enemy—it’s the price of long-term growth.

Let’s clear something up here: there has never been a five-year consecutive market downturn in the history of the stock market. The closest we’ve ever come to that was the Great Depression, from 1929–1932, when the market experienced four consecutive years of losses. And sure, there have been periods when the market has taken time to recover—sometimes 3, 4, or 5 years. But history tells us that if you have a long enough time horizon, the odds of losing money in the stock market are essentially zero.

What’s more dangerous than volatility is not growing your money enough to meet your long-term needs. Clients who are overly conservative during their working years, or worse, in retirement, are putting themselves at risk of underperforming over the long haul. If you invest too conservatively, you’re not leaving room for your portfolio to grow as fast as it needs to. And this is where the bucket strategy can make a huge difference.

With the bucket strategy, you have a built-in cushion to ride out volatility. You’ve got 5–6 years of funds in cash or bonds that allow you to ignore the short-term fluctuations and stick to your strategy. This means you won’t have to sell equities during a downturn, and when markets recover, you can replenish your cash bucket with the gains from your equities holdings.

And…when you combine the bucket strategy with portfolio rebalancing, you can make your money work double time for you!

The Emotional Impact of Market Downturns

One of the hardest things to do as an investor is stay the course during market downturns. Even the most seasoned investors will feel the emotional tug of seeing their account values drop. But here’s the thing: knowing you have a plan and understanding how your portfolio is set up to handle downturns gives you a huge edge.

I meet with my clients twice a year, and each time I reinforce the importance of sticking to the strategy, especially during downturns. When markets are down, I remind clients that their portfolios were designed with this very situation in mind. We’ve built a buffer into their portfolios, and this allows us to confidently weather volatility without making rash decisions.

But this requires education. For many it seems counterintuitive, and even scarry.

I haven’t done my job if the client is first hearing about their built-in buffer during a market downturn. If I’ve already done the work upfront and prepared them for these inevitable market cycles, they’re more likely to stay calm and let their investments work as intended.

Remember, your portfolio’s biggest risk isn’t volatility, it’s reacting emotionally in response to volatility.

A Real-Life Example: When Conservative Risk Tolerance Hurt

I had a client, nearing retirement, who was terrified of a market downturn. His previous advisor had set up his portfolio as an essential hedge against the market, in an attempt to make him feel safe. But after a decade, his portfolio had barely grown, and he was beginning to feel behind the 8-ball with respect to his retirement savings.

Once he came to me, we explained the bucket strategy and showed him how having a long-term allocation to equities didn’t actually mean more risk, but instead more opportunity for growth. After educating him on the power of long-term equities investing and how the bucket strategy would help manage volatility, he agreed to allocate a larger portion of his portfolio to stocks.

The results have been remarkable. In the year and a half since implementing the strategy, his portfolio has grown by 30%—30% more than it had over the previous decade! While this level of growth isn’t guaranteed or even expected most years, it’s a powerful example of how understanding the right strategy and allocating correctly can significantly improve your financial future.

Don’t Let Risk Tolerance Emotion Drive Your Investment Decisions

Ultimately, risk tolerance questionnaires are a poor substitute for a strategy that’s grounded in research and tailored to your financial goals. At my firm, I believe in research-driven portfolios that are designed to give my clients the best chance for long-term success.

I don’t let emotions dictate the strategy. I make sure the strategy fits your needs, time horizon, and goals, and I continuously educate my clients so they can make confident, informed decisions.

By embracing a strategy that aligns with when you need the money, not how you feel about it, you’re setting yourself up for a future where volatility isn’t something to fear—it’s something to embrace as a natural part of the market’s growth cycle.

If you or your current advisor is allowing the emotions of your “risk tolerance” to drive the bus, reach out. I’m happy to help you take control of your financial future and build a strategy that works for you. A strategy that fits what you need, not what you feel.