As Benjamin Franklin famously said, nothing is certain except for death, taxes, and market volatility…

OK, maybe I modified this a bit, but in the world of investing, market volatility is a certainty. Yet, this really isn’t something that should be feared but rather embraced and harnessed to give you the best possible investing results. Let’s take a look at something famous investor, mutual fund manager, and author Peter Lynch said all the way back in 1994:

“The market is going to go up and down. Human nature has not changed a lot in 25,000 years. And some event will come out of left field and the market will go down or the market will go up. So, volatility will occur and the market will continue to have these ups and downs.”

In other words, buckle up—it’s all part of the ride.

What is Market Volatility?

Volatility is simply the degree of variation in the price of an investment over time. These price swings can be caused by anything from political changes to economic shifts, to unpredictable events (or in 2024, even a tweet). The 24-hour news cycle amplifies this further, creating constant noise that can feel overwhelming for investors. But here’s the thing—volatility is normal. It’s a natural part of the market’s behavior and…more importantly…it’s essential for growth.

For those new to the term, volatility can seem like a bad thing. But smart investors understand that volatility creates opportunities. If you’re in the market for the long haul, these fluctuations shouldn’t shake your confidence. Instead, they should remind you to stay the course.

History Has Our Back

Let’s take a trip down memory lane with Peter Lynch. In 1994, when the Dow was sitting around 3,800, Lynch noted that corporate profits grow by around 8% a year, meaning profits—and the market—should double every nine years. Lynch put it this way:

“Basically, corporate profits have grown by about 8% per year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years.”

Here’s what that looked like in practice:

- 1994: 3,800

- 2003: 7,600

- 2012: 15,200

- 2021: 30,400

Spoiler alert: Lynch was pretty much spot on.

Here’s what actually happened:

- 1994: 3,800

- 2003: 8,300

- 2012: 12,200

- 2021: 30,600

- 2024: Roughly 43,000 (yep, on track for another doubling)

What does this tell us? The market’s long-term trajectory tends to be up, up and away—no matter the short-term noise. Lynch’s predictions weren’t based on crystal ball magic; he was simply applying common sense to overall market trends. Over time, corporate profits grow, and as they do, the market rises with them. It’s basic economics at work—profits drive stock prices.

The Simple Truth of Investing: Don’t Sell

Lynch’s advice is ridiculously simple: Invest in the market and never sell.

Yep, that’s it.

He points out, “Successful investing is incredibly simple,” but somehow, many investors make it complicated by trying to outsmart the market.

Spoiler alert: Market timing is a losing game. You’re better off holding steady, letting the market’s long-term growth work for you.

But why is holding so important? In the short term, it’s easy to panic when you see your portfolio drop by 10%, 20%, or even more. Human psychology makes us risk-averse—we tend to fear losses far more than we enjoy gains. This is why so many investors sell during downturns, locking in their losses, only to miss out when the market eventually recovers.

And yes, the market always recovers.

The problem with trying to time the market is that no one—not even Peter Lynch—knows exactly when those recoveries will happen. Lynch has repeatedly emphasized that even he can’t predict the next market move. But what he can predict with certainty is that over time, the market will continue to grow.

The Long Game Wins

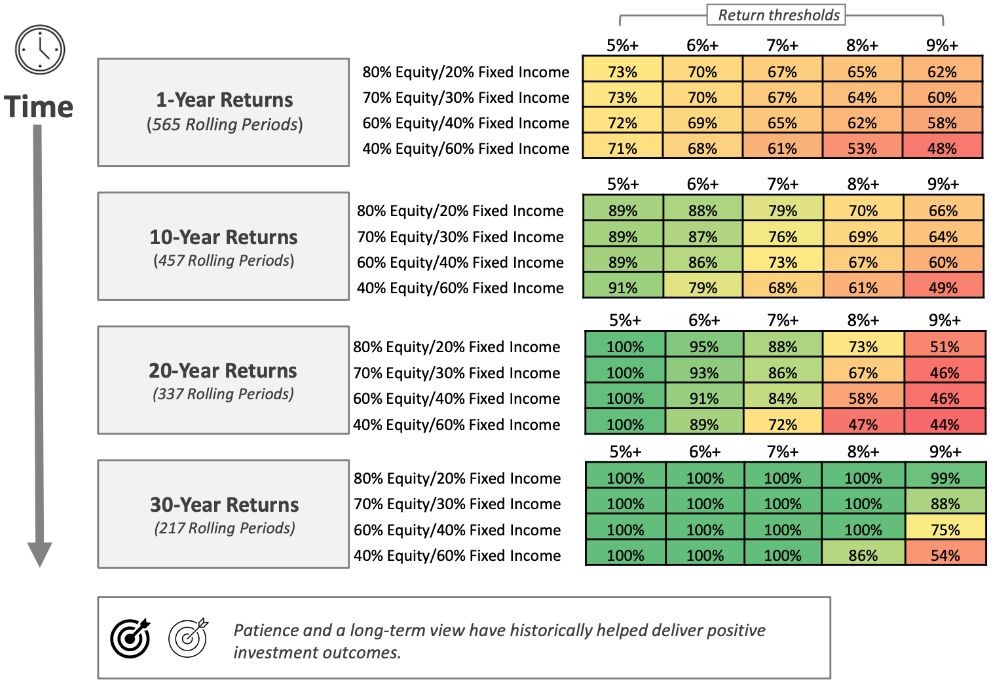

When you take a long view of the market, the impact of volatility diminishes significantly. Check out the chart below for some insight into how different equity/fixed-income mixes perform over various time horizons:

Source: Why Long-Term Investors Reap the Biggest Rewards | Advisorpedia

Notice something? When you extend your view over 20 or 30 years, the chances of achieving significant positive returns increase dramatically. That’s the magic of long-term investing. As time goes on, volatility smooths out, and you can be nearly certain your portfolio will increase. Take an 80% equity/20% fixed income portfolio, for example: Over a 30-year period, the chances of achieving a 9% or higher return has happened nearly 100% of the time!

If you are a client of mine, you are likely familiar with my bucketed approach to retirement income. One of the biggest reasons that I utilize this approach is exemplified in the chart above…that is if given enough time the market is almost never down. Only twice in the history of the S&P 500 has this market index been down for 3 consecutive years, from 1939-1941 and again when the dot com bubble burst from 2000-2002.

So, while it does happen (though infrequently) my clients who are actively withdrawing from their portfolio have short and mid-term buckets in conservative assets that give the market time to recover when it does perform poorly. This prevents them from ever needing to draw money from an asset that has lost value.

This is why the long game wins. Patience, perseverance, and the right withdrawal strategy allow you to ride out the temporary downturns and capture the market’s upward trajectory.

Patience is a Virtue Your Best Friend

In today’s world, where everyone expects instant gratification (looking at you, Amazon Prime), patience can feel like a lost art. But when it comes to investing, the ability to wait for the market to fulfill its potential is priceless. As Lynch puts it, “Volatility will occur and the market will continue to have these ups and downs.” But so what? Volatility isn’t a bug in the system—it’s a feature.

In fact, investors who have the patience to endure these ups and downs are certain to be the ones who come out on top. Those who sell during downturns usually miss the best days of market recovery. Historically, missing even just a handful of the best market days in a decade can significantly reduce your overall return.

Embrace the Volatility Ride, Don’t Fear It

Here’s the reality: Market downturns are where seasoned investors can swoop in and buy quality companies at a discount. Think of it like a sale! While we don’t advocate for trying to time the market, it’s pretty clear that times of volatility can also be times of opportunity.

Lynch has often pointed out that the best stock market opportunities often arise in times of fear—when everyone else is running for the exits. Investors who understand this can take advantage of low prices during downturns and capture future gains as the market recovers. But you can’t do that if you sell out of panic.

Learn From the Past

History shows us that the market rises over time, despite short-term dips. Even in the face of recessions, political turmoil, or global pandemics, corporate profits (and markets) continue to grow. Lynch’s point? Don’t get scared off by a bad day, month, or even year. The market’s upward trend is where the magic lies, and only those who stay invested will fully capture it.

In fact, many investors make the mistake of getting caught up in short-term thinking. They panic when they see a headline about a market drop or sell when a company reports lower-than-expected earnings for the quarter. But in the grand scheme of things, these moments are just tiny blips on the radar. The long game is what matters.

Common Investor Pitfalls

Even with this simple game plan, many investors fall into common traps, like:

- Market timing: Trying to guess the perfect moments to buy and sell usually backfires.

- Emotional decision-making: Acting on fear or greed can throw your whole strategy off course.

- Lack of research: Understanding what you’re invested in helps you avoid panic when the market wobbles.

By staying educated and grounded, you’ll be in a far better position to avoid these mistakes.

The Final Takeaway: Play the Long Game

Peter Lynch’s approach is clear: Long-term investing beats short-term speculation every time. While we can’t predict what the market will do tomorrow, next week, or next month, we can be confident that over time, the market has historically rewarded patient investors.

So, buckle up, ignore the noise, and stay focused on your long-term goals.

You’ll be glad you did.

This post is for education and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.