When it comes to planning for retirement, annuities are often touted as a silver bullet. These financial products promise guaranteed income and security, making them appealing to many approaching their golden years. However, beneath the surface of these shiny promises lie several misconceptions that can significantly impact your financial well-being. In this blog, we’ll explore what annuity salespeople often get wrong and how you can navigate these pitfalls to make informed decisions for your retirement.

I do think that it is important to point out that I am neither pro- nor anti-annuity. I am simply an advocate for their proper usage. I am licensed to sell annuities, and it is not uncommon that they end up as a portion of my clients’ portfolios. However, I am vehemently opposed to some of the claims, strategies, and overselling that plagues the industry. For many this simply leads to a label of all annuities are bad, however that would be an over-simplification. While bad annuities do exist, they certainly aren’t all bad. My hope is that I can provide a more nuanced perspective in a world that tends to creep towards the extremes.

1. The Flexibility Fallacy

One of the most significant issues with annuities, particularly those with long surrender periods, is their lack of flexibility. An annuity is essentially a contract where you exchange a lump sum of money for a guaranteed income stream. While this can be a solid choice for some, the long surrender periods—often 8, 10, or even 12 years—can severely restrict your ability to adapt your financial plan as circumstances change.

Consider Fred, a client who was sold a fixed-index annuity (FIA) in his 40s. While FIAs can be a good fit for certain investors, they often don’t provide the same growth potential as investing in equity mutual funds. Over five years, Fred’s FIA failed to keep pace with market growth, and he ended up withdrawing with less than he originally invested due to surrender fees. In contrast, an equity index fund would have nearly doubled his investment over the same period. This lack of flexibility left Fred significantly behind in his retirement savings goals.

The crux of the issue here is that long surrender periods can prevent you from adjusting your investment strategy to better suit your needs. If your financial situation changes, or if a more suitable investment opportunity arises, you might find yourself stuck with an annuity that no longer serves your best interests.

2. The Illusion of Back-Tested Performance

Another common misconception about annuities involves the use of back-tested indices. Salespeople often present these indices as proof of the annuity’s potential performance, showing impressive results based on a relatively short period of back testing. While these projections can look appealing, they are often misleading.

Back testing is about the opposite of Biff giving his younger self the sports almanac in Back to the Future…all these things have already happened and are unlikely to repeat. All the while the companies are acting as if since it’s happened in the past, its bound to happen again. It’s a classic case of confirmation bias, where past success is mistakenly assumed to guarantee future results. The reality is that market conditions change, and indices based on short-lived periods can give a false sense of security.

Investors should be cautious of projections that rely heavily on back-tested performance. It’s important to remember that past performance is not indicative of future results. Rather than relying solely on these projections, a more comprehensive understanding of how an annuity works and its potential risks and rewards is essential.

3. Sales Incentives and Limited Expertise

The annuity sales industry often operates on commissions, which can create a conflict of interest. Salespeople who earn a commission for each annuity sold may have a financial incentive to recommend these products, even if they aren’t the best fit for the client. This can lead to overselling and an overemphasis on the benefits of annuities, sometimes at the expense of more suitable alternatives.

Additionally, many annuity salespeople are only licensed to sell insurance products and may not have a comprehensive understanding of broader investment strategies. This limited scope can lead to a narrow perspective, where annuities are viewed as the solution to all financial needs. It’s crucial for clients to recognize that not all financial advisors have a holistic view of retirement planning. Seeking advice from professionals who can offer a range of investment options and strategies is key to developing a well-rounded retirement plan.

4. The Complexity of Fixed Indexed Annuities (FIAs) and Variable Annuities

FIAs are often marketed for their potential to provide downside protection while offering market-linked returns. However, they can be misunderstood due to their complexity. FIAs track an index created by the issuing insurance company. The returns credited to the account depend on how this underlying index performs, and while your principal is guaranteed, the growth potential can be limited. The annuity’s crediting method—often involving caps, participation rates, and spreads—can obscure how returns are calculated and might not align with the client’s expectations of market-like growth.

Variable annuities, on the other hand, involve subaccounts that directly hold securities, making the annuity’s value variable. While variable annuities can offer investment options similar to mutual funds, they often come with higher fees. These can include management fees for the subaccounts, insurance fees, administrative fees, and mortality and expense risk charges. Over time, these fees can significantly erode returns, making variable annuities an inefficient way to hold securities compared to lower-cost investment options.

When Annuities Do Make Sense

Despite their limitations, annuities can play a valuable role in retirement planning, especially when used strategically. The primary benefit of annuities is their ability to provide guaranteed income, which can be a crucial component of a secure retirement plan.

For clients approaching retirement, it might make sense to allocate a portion of their nest egg to an annuity. For example, if you are approaching retirement with Social Security as your only fixed income, you might consider using an annuity to guarantee that your fixed expenses are covered. This can provide peace of mind knowing that essential costs are taken care of regardless of market conditions.

Annuities can also be useful as a bridge strategy. For instance, if you plan to delay taking Social Security benefits until age 70 to maximize your monthly payout, an annuity can provide income from your early retirement age until you start receiving Social Security. This approach allows you to benefit from a higher Social Security payment while still maintaining a reliable income stream in the interim.

Balancing Annuities with Equity Investments

One of the most critical considerations when integrating annuities into a retirement plan is ensuring that they do not dominate your portfolio. While annuities can provide guaranteed income, they often come with trade-offs, such as limited growth potential and the loss of principal upon annuitization.

To mitigate these drawbacks, it’s essential to maintain a balance within your portfolio. A well-diversified portfolio, particularly in retirement, should include a mix of assets that can provide both stability and growth. This is where equity investments come into play. Historically, equities have offered higher returns compared to fixed-income products and annuities.

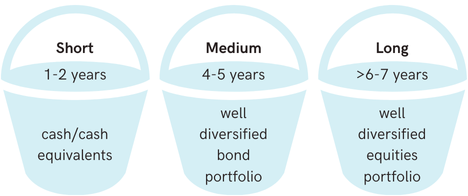

A practical approach is to use a bucket strategy for managing retirement assets. This involves dividing your investments into different “buckets” based on your short-term and long-term needs. For example:

- Bucket 1: Cash and cash equivalents to cover 1-2 years of living expenses.

- Bucket 2: Bonds and other fixed-income investments to cover the next 3-5 years of expenses.

- Bucket 3: Equities for growth and to cover expenses beyond the initial 5-6 years.

This strategy allows you to take advantage of equity growth while having safe assets to draw from during market downturns. By maintaining this balance, you can weather market volatility without needing to sell equities at a loss.

Common Misconceptions and Myths

Many clients express dislike for annuities without fully understanding them, often due to complex illustrations or misleading sales pitches. This misunderstanding is sometimes driven by poorly structured annuities and a lack of transparency. It’s crucial to address these misconceptions by simplifying the information and focusing on how annuities fit into the broader financial plan.

Educating clients about annuities involves demystifying their features and explaining them in straightforward terms. Unfortunately, many annuity illustrations show overly optimistic returns based on historical performance that may not accurately reflect future outcomes. It is essential for advisors who offer annuities as a solution to fully understand the mechanics of these policies and accurately depict the expected long-term returns. Providing comprehensive education about the potential risks and limitations of annuities, along with alternative options, is crucial.

Informed Annuity Decisions

In the world of retirement planning, annuities can be a useful tool when used appropriately, but they come with their own set of challenges and misconceptions. Understanding the limitations of annuities, the potential for misleading projections, and the incentives of salespeople is crucial in making informed decisions.

Education is key to navigating these complexities. By arming yourself with knowledge and working with a financial advisor who can provide a broad perspective, you can make better decisions that align with your retirement goals. Remember, a well-rounded approach that balances annuities with other investments will give you the best chance of achieving a secure and prosperous retirement.

If you’re considering an annuity or have questions about how it fits into your retirement plan, reach out to a trusted financial advisor who can help guide you through the process. Remember, the goal is to retire with abundance, and that starts with making informed decisions today.