Rules of thumb can often provide guidance in the complex world of personal financial planning. While almost all rules of thumb were originally based on a form of sound and practical financial advice, blindly following these common principles can lead to negative outcomes. Whether it’s saving for retirement, budgeting for children, or managing your portfolio, these commonly accepted guidelines tend to oversimplify and if followed blindly could lead to negative outcomes. By challenging conventional wisdom and exploring a more individualized approach, this blog should help empower you to make more informed choices on your path to financial freedom.

Rule #1: 100 – Age = Equities Allocation

The first rule we explore deals with how to allocate your portfolio. A recurring theme in the rules of thumb to avoid is that your individualized situation and goals are not considered in developing this plan. While that is certainly true for this particular rule of thumb, that is just the beginning of it. While of course your asset allocation should be custom fit based on your goals, generally speaking, this rule gives you way too conservative of an allocation way too quickly. For example, a 40-year-old who is still 25+ years away from retirement should be willing to be much more aggressive than a 60/40 portfolio which is more akin to what most retirees portfolios should look like.

Rule #2: Retirement Income = 70% of Pre-Retirement Income

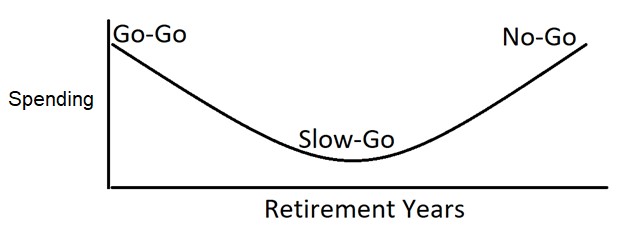

It can be said ad nauseum for these rules of thumb, but taking an arbitrary percent is not reflective of any individual goals. Another difficulty with this rule is that a static number is generally not reflective of the retirement experience. Most retirees end up retiring with a smile…that is their spending takes on the shape of a smile. (See my beautiful sketch below!)

The three spending phases of retirement can be aptly named the Go-Go years, the Slow-Go Years, and the No-Go years. The Go-Go years are a time of higher levels of spending due to finally being able to do what you always wanted without the restraints of those pesky work responsibilities. Over time, the Go-Go years give way to the Slow-Go years, where you are still active but maybe not as adventurous or willing to take on new opportunities. This generally marks a period of relatively low levels of spending in retirement. Finally, the No-Go years…where you’re not leaving the building, until you’re leaving the building. This marks another period of higher costs due to healthcare concerns. Obviously, everyone’s retirement ends up looking a little bit different, but projecting your retirement income on an arbitrary percentage of your pre-retirement income turns out to be inefficient and inaccurate. Besides, with just a little bit of work it’s relatively easy to actually figure out what your spending in retirement will most likely look like. (Go here to learn more about how to know if you have enough to retire.)

Rule #3: The 4% Rule

The 4% rule acts as a guide for safe withdrawal rates. Stated simply, the rule says that you can take 4% of your portfolio’s value in the initial year of retirement, increase it for inflation year over year, and doing so gives you some level of guarantee that you won’t run out of money. While this rule is backed by academic rigor, and we are certainly not challenging the validity of the assertions made by Bill Bengen in his landmark 1994 paper, we simply believe that there is a better way. In part because of the phases of retirement discussed above in rule #2, and also based on later research done by Jonathan Guyton and William Klinger on dynamic withdrawal strategies. At my firm, we find the 4% rule to be too rigid, and in practice, leads to lower than necessary withdrawal rates. Lower levels of flexibility and lower withdrawal rates almost certainly leads to lower levels of fun in retirement ☹.

Rule #4: Stocks are Risky, Bonds are Conservative

It is definitely worth exploring your definition of risk…in investing, most risk is defined by standard deviation, a measure of volatility in the market. While it is certainly true that stocks have a higher standard deviation, it is worth it to have a more comprehensive view of risk. At QED, we look at multiple types of risk, including but not limited to market risk, mortality risk, inflation risk, regulatory risk, long-term care risk and longevity risk. Longevity risk actually acts as a risk multiplier, because the longer you live, the more likely you are to experience all of the other risks. While most retirees #1 fear is running out of money, many unwittingly increase this risk by playing it too safe with their investments. Couple this with the simple fact that inflation erodes your money’s purchasing power year over year, and it is easy to see that being overly conservative with your investments does not actually decrease your risk, but exponentially increases risk around the very thing that retirees are most worried about.

While these retirement rules of thumb can provide a sense of direction, it’s crucial to evaluate them carefully and have the knowledge and confidence to veer away when the rule turns out to not be in your best interest. By understanding the nuances of your personal financial situation, educating yourself, and seeking professional advice when needed, you can achieve the financial freedom that you have always dreamed of. If you are approaching retirement and are unsure where to start, consider downloading our free Ultimate Retirement Planning Checklist today.

This post is for educational and entertainment purposes only. Nothing should be construed as investment, tax, or legal advice.